lowes tax exempt card

Yes o No If yes please provide tax exempt certificate via fax or in store. With the Lowes Advantage Card youll save each time you spend when you use the everyday discount of 5 off your eligible purchase or order charged to your Lowes account.

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Lowes Pro Supply Purchase Card is intended for commercial use only not for personal household or family purposes.

. Create a New Tax-Exempt Account. Lowes tax exempt card Friday May 20 2022 Edit. Sign in with the business account you will be making tax exempt purchases with.

Lowes Tax Exempt Number Print Page Tax Exempt Number for Commercial Card Users Present this number before each purchase you make at any Lowes for University business purposes. Yes you must have a Tax-Exempt certificate on file with Lowes AND you must verbally self-identify at checkout in stores that you are tax-exempt for the Purchase Card transaction to not be taxed. The entities that qualify for sales tax exemption in oklahoma are specifically legislated.

Lowes Pro Supply Purchase Card is intended for commercial use only not for personal household or family purposes. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. As of January 1 2007 the Corporate Tax Rate is 884.

Vendors must collect tax. Up to 8 cash back Let us know and well give you a tax exempt ID to use in our stores and online. Select Tax Exemptions under the Account Details section.

If more than 3 submit a seperate list and idicate if they need cards. Selling as per the terms and conditions bill of sale with supporting documentation. Lowes tax exempt card Friday May 20 2022 Taxes are 9676 annually.

As far as Special Financing goes the Lowes Advantage Card offers the option to pay over a period of time for purchases of 299 or more. Check the box if you want a Physical ID Card issued for each Authorized Buyer added. Purchases of these products are subject to tax at the rate listed in Part 2 of Publication 718-R in those localities that tax energy sources and services.

If more than 3 submit a seperate list and idicate if they need cards. All purchases made with a University p-card are exempt from North Carolina State sales tax. If discretionary funds are used.

If you have a Federal Government Purchase Card no additional registration is required. Is your business tax exempt. You consent to Lowes Synchrony Bank SYNCB and any other.

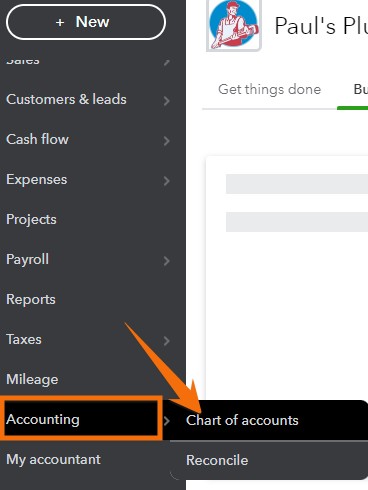

Confirm that the account listed is accurate. To get started well just need your Home Depot tax exempt ID number. Select Link Certificate and enter the TEMS ID which is the same as your Lowes customer ID or Lowes tax-exempt account ID.

Gift certificates and cards with a value greater than the tax reportable limits specified in Policy 60211 may not be purchased without advanced written approval from the Tax Office. Yes you must have a Tax-Exempt certificate on file with Lowes AND you must verbally self-identify at checkout in stores that you are tax-exempt for the Purchase Card transaction to not be taxed. Have your local Lowes store provide your Lowes customer ID or Lowes tax ID.

FOR OUR GOVERNMENT BUYERS WITH FEDERAL GOVERNMENT PURCHASE CARD 1. Advanced approval must be. Lowes W9 Fill Online Printable Fillable Blank Pdffiller Yes o No If yes please provide tax exempt certificate via fax or in store.

Offer not valid on any Lowes Pro Supply sale. Stove or fireplace used for residential heating purposes are also exempt from the local tax in those localities that exempt residential energy sources and services. No need to register.

Once youre approved shop in our stores or online and simply provide your tax ID at checkout to receive tax exemption on your eligible purchases. If this number is not presented at the time of purchase you will be charged sales tax. Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook All registrations are subject to review and approval based on state and local laws.

View or make changes to your tax exemption anytime.

Resale Certificate Request Letter Template 1 Templates Example Templates Example Letter Templates Certificate Templates Lettering

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Tax Exempt Stores Who Honor The Tribal And Band Cards Posts Facebook

Attaching Tax Exempt To Business Acct R Lowes

Automate Your Lowe S In Store And Online Receipts

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate R Letter Example Resume Template Examples Cover Letter Template

Tax Exempt Management System Lowe S

Tax Exempt Management System Lowe S

What Credit Score Is Needed For A Lowe S Card Credit Card Statement Credit Card Application Rewards Credit Cards

Applying For Credit Cards After Bankruptcy Forbes Advisor

Tax Exempt Management System Lowe S

Resale Certificate Request Letter Template 11 Templates Example Templates Example Letter Templates Certificate Templates Business Plan Template

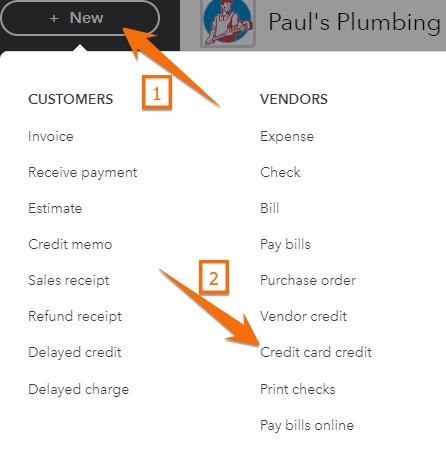

How To Enter A Credit Card Refund In Quickbooks Online

How To Enter A Credit Card Refund In Quickbooks Online

Kraft 12 X 12 Cardstock Paper By Recollections 25 Sheets Michaels